What you need to know:

- Kasaija also revealed an increase in excise duty on imported wines, raising it from 80% or Shs 8,000 per liter to 100% or Shs 10,000 per liter, whichever is higher.

- Additionally, the budget introduced other tax measures including a new levy of Shs 100 per liter on diesel and petrol, and excise duty on products like adhesives, grout, white cement, and lime, aligning their tax treatment with that of cement.

For many Ugandans, beer evokes nostalgic memories of warmth shared with friends or a refreshing way to unwind after a long day. However, in the upcoming fiscal year, they will face higher costs for their favorite beverage due to increased government taxes.

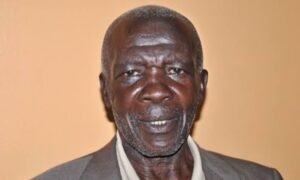

Finance Minister Matia Kasaija recently announced new taxation measures aimed at the alcohol industry, particularly targeting imported beers and wines. Despite some analysts’ views that the budget for the financial year 2024/25 wasn’t overly burdened with taxes, the minister imposed an additional tax of Shs 1,000 per kilogram on powdered beer.

This alcohol excise tax is expected to impact the final price of powdered beer, which has gained popularity among revelers at top bars and clubs for its unique instant preparation method, turning powder into beer with water.

Kasaija also revealed an increase in excise duty on imported wines, raising it from 80% or Shs 8,000 per liter to 100% or Shs 10,000 per liter, whichever is higher. This move follows concerns raised by industry players in the past about the level of excise duties on alcoholic beverages.

In March, Uganda Breweries Limited (UBL) had expressed concerns over proposed tax hikes on spirits, which did not see any new changes in the latest budget announcement. The existing excise duties on spirits remain unchanged.

Additionally, the budget introduced other tax measures including a new levy of Shs 100 per liter on diesel and petrol, and excise duty on products like adhesives, grout, white cement, and lime, aligning their tax treatment with that of cement.

Moreover, starting from the new financial year, withdrawals from electronic banking wallets other than mobile money will be subject to a 0.5% excise duty on the withdrawal value, excluding transactions from agent banking or banking halls.

The budget also includes exemptions to support the growth of electric mobility, making electric vehicles, motorcycles, charging stations, and related components tax-free. Furthermore, tax incentives such as income tax holidays were announced for manufacturers of electric vehicles and medical facilities, aiming to stimulate investment in these sectors.

Despite Uganda’s rising public debt, which stood at Shs 93.38 trillion ($24.69 billion) with external debt at Shs 55.37 trillion ($14.64 billion) and domestic debt at Shs 38.01 trillion ($10.05 billion), Kasaija reassured that the debt remains sustainable. He emphasized that borrowed funds have been invested strategically and are yielding positive returns for the economy.

Overall, while the budget introduces several tax adjustments and measures, the government aims to balance revenue generation with stimulating economic growth and investment.

Do you have a story or an opinion to share? Email us on: info@falconposts.com Or follow the Falconposts on X Platform or WhatsApp for the latest updates.