What you need to know:

- The newly appointed head of the Uganda Bankers Association (UBA) has expressed a commitment to prioritize Environmental, Social, and Governance (ESG) issues to strengthen the sector’s accountability to society, its clientele, and stakeholders.

- However, Kakeeto acknowledged challenges facing the industry, including the need to grow a robust base of creditworthy borrowers, combat e-fraud, and address high operational costs stemming from various factors such as delays in settlements and poor infrastructure.

The newly appointed head of the Uganda Bankers Association (UBA) has expressed a commitment to prioritize Environmental, Social, and Governance (ESG) issues to strengthen the sector’s accountability to society, its clientele, and stakeholders.

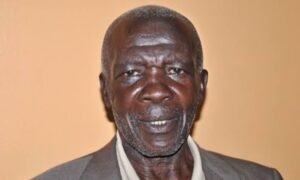

Julius Kakeeto, the recently elected UBA Chairman and CEO of PostBank Uganda, emphasized the importance of business sustainability in today’s landscape. He highlighted this during an interview following his election at the association’s Annual General Meeting (AGM) in Kampala on May 17.

Kakeeto emphasized that promoting ESG principles would solidify the sector’s growth trajectory, which he described as stable and resilient. He provided updates on the industry’s performance, indicating a 7.5% increase in total assets for Supervised Financial Institutions (SFIs) from Shs45.8 trillion in 2022 to Shs49.5 trillion by the end of 2023. Additionally, he noted a decrease in the non-performing loan ratio from 5.3% to 4.6% and a rise in aggregate industry profitability from Shs1.2 trillion to Shs1.4 trillion during the same period.

Furthermore, Kakeeto highlighted significant investments in information communication technology (ICT) and digital channels within the industry, with ICT spending nearly doubling from Shs392bn in 2022 to Shs694bn in 2023. He assured that most member banks and financial institutions have met new capital requirements, positioning them to continue supporting customers and the economy.

Identifying opportunities in the market, Kakeeto emphasized the potential within the small and medium-sized enterprise (SME) sector, particularly in industries such as oil and gas, construction, real estate, agro-processing, and manufacturing. He also highlighted opportunities in infrastructure development and the growing services industry, spanning hospitality, health, education, and ICT services.

However, Kakeeto acknowledged challenges facing the industry, including the need to grow a robust base of creditworthy borrowers, combat e-fraud, and address high operational costs stemming from various factors such as delays in settlements and poor infrastructure.

Looking ahead, Kakeeto emphasized the sector’s pivotal role in supporting key pillars of the economy outlined in the NDP III, including trade, manufacturing, exports, infrastructure development, housing, urban development, tourism, and ICT.

Do you have a story or an opinion to share? Email us on: info@falconposts.com Or follow the Falconposts on X Platform or WhatsApp for the latest updates.