What you need to know:

- Mwangi highlighted that the bank’s regional subsidiaries have improved efficiency, contributing 47% to the group’s balance sheet in terms of deposits and loans, and driving a 55% increase in revenue.

- The growth in deposits led to a 55% rise in cash and cash equivalents to $2.

Equity Group, Kenya’s largest bank by market capitalization, reported a 12.5% increase in net profit for the first half of 2024, despite challenging macroeconomic conditions that led to loan defaults by businesses and individuals.

On Monday, the bank announced a net profit of $229 million (KES29.6 billion), up from $203.4 million (KES26.3 billion) in the same period in 2023, driven by strong interest income. The bank’s interest income grew by 22% to $656 million (KES84.8 billion), despite high inflation and interest rates.

Equity Group’s performance comes as major Kenyan banks focus on regional expansion amid slowing growth in East Africa’s largest economy.

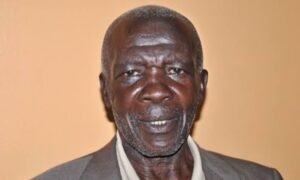

“We are now a regional bank, with nearly half of our balance sheet and profit and loss statement moving outside Kenya,” said James Mwangi, Group Managing Director and CEO.

Mwangi highlighted that the bank’s regional subsidiaries have improved efficiency, contributing 47% to the group’s balance sheet in terms of deposits and loans, and driving a 55% increase in revenue.

The bank also saw a steady 16% growth in non-interest income, reaching $737.2 million (KES95.1 billion). Customer deposits increased by 11% year-on-year to $10 billion (KES1.3 trillion), and the customer base now stands at 20.7 million.

The growth in deposits led to a 55% rise in cash and cash equivalents to $2.6 billion (KES341 billion) and an increase in investment securities to $3.5 billion (KES459 billion), strengthening the bank’s liquidity position.

Equity’s gross non-performing loans (NPLs) rose by 4.4% to $929.4 million (KES119.9 billion), prompting the bank to increase provisions for loan defaults by 35% to $65.8 million (KES8.5 billion). The Central Bank of Kenya mandates banks to set aside funds for loans where borrowers fail to pay the principal or interest for 90 days.

“We are proud that Equity Group maintains a strong cushion on key balance sheet buffers, including liquidity, capital, and NPL coverage, while continuing to report above-industry profitability metrics,” Mwangi stated.

Do you have a story or an opinion to share? Email us on: info@falconposts.com Or follow the Falconposts on X Platform or WhatsApp for the latest updates.