What you need to know:

- Rujooki made these remarks while addressing manufacturers and the media during the presentation of the Impact of Digital Tax Stamps report, a collaboration between the Private Sector Foundation Uganda and PricewaterhouseCoopers (PwC) at Serena Hotel, Kampala.

- However, the aggressive adoption of the DTS system in fiscal year 2020 led to a subsequent average decline of 7% in LED collections.

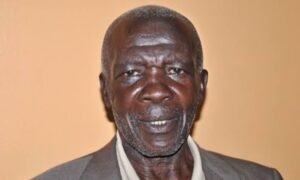

The Uganda Revenue Authority (URA) has lauded the Digital Tax Stamps (DTS) for fostering fairness in the market among compliant manufacturers. According to URA Commissioner General John Musinguzi Rujooki, the implementation of DTS has effectively curbed the circulation of illicit goods, ensuring an equitable environment for manufacturers adhering to tax regulations.

Rujooki made these remarks while addressing manufacturers and the media during the presentation of the Impact of Digital Tax Stamps report, a collaboration between the Private Sector Foundation Uganda and PricewaterhouseCoopers (PwC) at Serena Hotel, Kampala.

He pledged to address concerns regarding the implementation costs of DTS in Uganda, emphasizing the paramount importance of manufacturer interests in policy formulation. Rujooki highlighted ongoing efforts to negotiate cost reductions with the provider, SICPA, as compliance improves and milestones are achieved.

Furthermore, he noted tangible reductions in stamp costs for spirits, beers, and Kombucha, urging manufacturers to consider the broader benefits of DTS beyond its pricing implications. Rujooki emphasized that while adjustments may be necessary, the initiative has effectively sanitized the market from untaxed goods, providing a level playing field for compliant manufacturers.

His comments came in response to Simon Kaheru, the East African Business Council Board Chair and communications director for Coca-Cola Beverages, who criticized the high costs of DTS as burdensome for manufacturers.

Zackey Kalega, the Commissioner for Internal Trade, representing the Minister of State for Trade, echoed the ministry’s commitment to ongoing dialogue with manufacturers to balance revenue optimization and trade growth. He highlighted the ministry’s focus on combating illicit trade and emphasized the importance of consumer protection through the universal application of DTS across all businesses.

Agnes Ssali, the Legal Director and Company Secretary, underscored the detrimental impact of illicit trade on Uganda’s manufacturing sector, particularly in the alcohol industry. She advocated for digitalization as a solution to combat misuse and under-declaration associated with DTS.

Despite challenges in compliance, URA has conducted extensive workshops and training sessions to facilitate businesses’ understanding and integration of DTS into their operations. However, non-compliance remains a significant obstacle. Nonetheless, the report indicates a notable growth in Domestic Revenue collections since the introduction of DTS in 2019.

Prior to DTS implementation, Local Excise Duty (LED) collections experienced significant growth, increasing by 12% to UGX 2.13 trillion from July 2016 to June 2019. However, the aggressive adoption of the DTS system in fiscal year 2020 led to a subsequent average decline of 7% in LED collections. This decline was followed by an average increase of 13% in LED collections, totaling UGX 2.74 trillion, in the post-DTS period spanning from July 2020 to June 2023. Overall, this represents a 9% LED revenue growth rate between July 2016 and June 2023.

Do you have a story or an opinion to share? Email us on: info@falconposts.com Or follow the Falconposts on X Platform or WhatsApp for the latest updates.